A strong data room tells a buyer how your company works before a single meeting starts. Files open quickly, names make sense, sensitive items are controlled, and questions route to the right people. Aim for that experience from day one. Treat the data room like a product that supports your deal.

Choose a virtual data room (VDR) built for diligence

Shortlist established providers used on sell-side processes: iDeals, Intralinks, Datasite, Ansarada, and Firmex. These platforms focus on permissioning, audit trails, Q&A workflows, optical character recognition, and admin safeguards that generic cloud drives struggle to match.

When you compare vendors, verify:

- Independent security frameworks. Ask for proof of an ISO/IEC 27001–certified information security management system. It shows the provider runs a formal ISMS with ongoing risk management and monitoring.

- Assurance reporting. Request a current SOC 2 report or bridge letter. SOC 2 evaluates controls relevant to security, availability, processing integrity, confidentiality, and privacy.

- Granular permissions. Folder and file-level access, view-only, dynamic watermarks, disabled downloads, expiry controls, and fast revocation.

- Admin ergonomics. Bulk upload, structured indexing, built-in redaction, and clean activity logs.

- Q&A workflow. Role-based routing, status labels, and exports for counsel.

Data room folder structure that buyers understand

Keep the index short and intuitive. Use numbered folders and avoid deep nesting.

- Corporate – cap table, charters, shareholder agreements, board minutes.

- Financials – audited statements, monthly management accounts, KPIs, budget, forecast model.

- Tax – filed returns, assessments, transfer pricing documentation.

- Commercial – top customer contracts, pricing policies, ARR by cohort, churn and retention.

- Product and IP – ownership proofs, patents and trademarks, third-party licenses, escrow terms.

- Legal and compliance – NDAs, litigation, regulatory correspondence.

- HR – headcount, templates, option plan docs, key employment agreements.

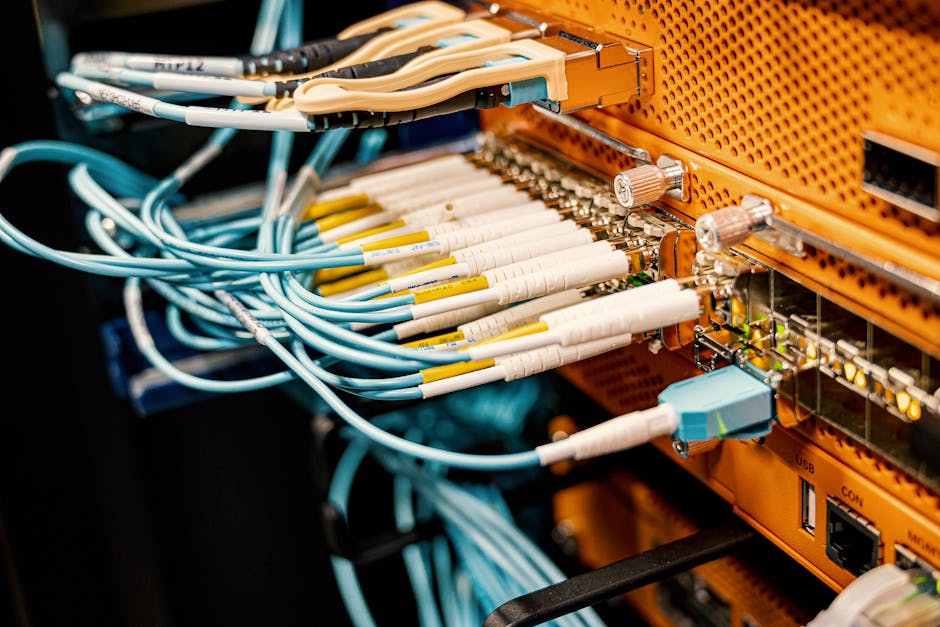

- IT and security – architecture diagrams, vendor inventory, security policies, incident summaries.

Name files so they sort cleanly, for example 02_Financials_2023_Audited.pdf. Do not bury key agreements in subfolders with vague labels.

Upload a Phase-1 essentials pack

Front-load what every buyer screens first. Add depth later as questions arrive.

- Audited financials for three years and the year-to-date pack.

- Top twenty revenue contracts and any agreement with change-of-control language.

- Proof of IP ownership and license terms that affect distribution or pricing.

- Security and privacy artifacts: policies, risk register excerpt, incident response summary.

- Product overview: architecture, key dependencies, hosting model, and environment diagram.

Access control that protects speed

Create buyer groups by workstream, for example commercial, finance, legal, and technology. Grant by folder, not by file, and default to least privilege. Turn on view-only for sensitive materials such as source code excerpts and customer PII exhibits. Apply dynamic watermarks with company name, user, and timestamp. Keep a small internal admin group that manages Q&A and sees the full audit log.

If your diligence includes reviewers in the EU, the United States, or Israel, ensure your NDA and privacy notice explain governing law and permitted data transfers. For EU personal data, confirm that your handling aligns with the GDPR principles published by the European Commission.

Q&A that reduces email noise

A good Q&A workflow keeps the deal moving and creates a clear record.

- Publish a one-page Q&A protocol in an “00_Info” folder with response targets and escalation.

- Tag each question by category and priority, then assign an owner.

- Where possible, answer with a document reference and, if needed, upload that item immediately.

- For issues that require a call, schedule tightly, then upload call notes to the Q&A folder.

Redaction and PII handling without drama

Use the VDR’s native redaction for personal data, bank details, secrets in contracts, and credentials. Keep the unredacted original in a locked subfolder reserved for later phases or post-signing. Test that redaction removes text rather than masking it by running a search on the exported file. For customer lists, start with an anonymized or grouped view in Phase 1, then release named detail after exclusivity or another milestone.

Go-live checklist for a sell-side data room

Before inviting buyers, run this quick check:

- Index is stable for the next two weeks.

- Watermarks, view-only, and download controls behave correctly in a dry run.

- Activity log records your test actions with accurate timestamps.

- Q&A routing and email alerts work for each owner.

- A concise read-me explains structure, naming, and request protocol.

- Version-control plan is set, with a visible changelog in “00_Info.”

Send invitations in waves. Start with a small champion group from the lead bidder to catch navigation issues. Fix once, then roll invites to the wider field.

Week-one habits that keep control

- Daily triage. Clear Q&A, push clarifications back quickly, and publish newly requested items without renaming sprees.

- Version hygiene. Replace files in place to preserve links, and log changes.

- Scope guardrails. When requests drift, tag them “Phase 2,” note the driver, and align the timeline with your adviser.

Vendor examples to anchor expectations

- iDeals – robust permissioning and practical Q&A for sell-side rooms at speed.

- Intralinks – frequent choice for complex or multi-party transactions.

- Datasite, Ansarada, Firmex – strong mid-market coverage with admin features sellers use daily.

Pick the platform your team can run without friction, with security evidence you can share on request. ISO/IEC 27001 certification and SOC 2 reporting give buyers confidence, and a tidy index lowers the number of meetings you need to explain the basics. A clean, secure, and searchable data room quietly accelerates diligence and lifts valuation conversations.